When most people think of cryptocurrency, they imagine Bitcoin trading, digital wallets, or blockchain innovations. But behind the booming adoption lies a high-stakes concern: cybersecurity. Crypto exchanges have become prime targets for hacks, fraud, and money laundering, making them one of the most vulnerable sectors in India’s financial ecosystem.

The big question is: How can India safeguard investors, exchanges, and the broader digital economy from cyber risks?

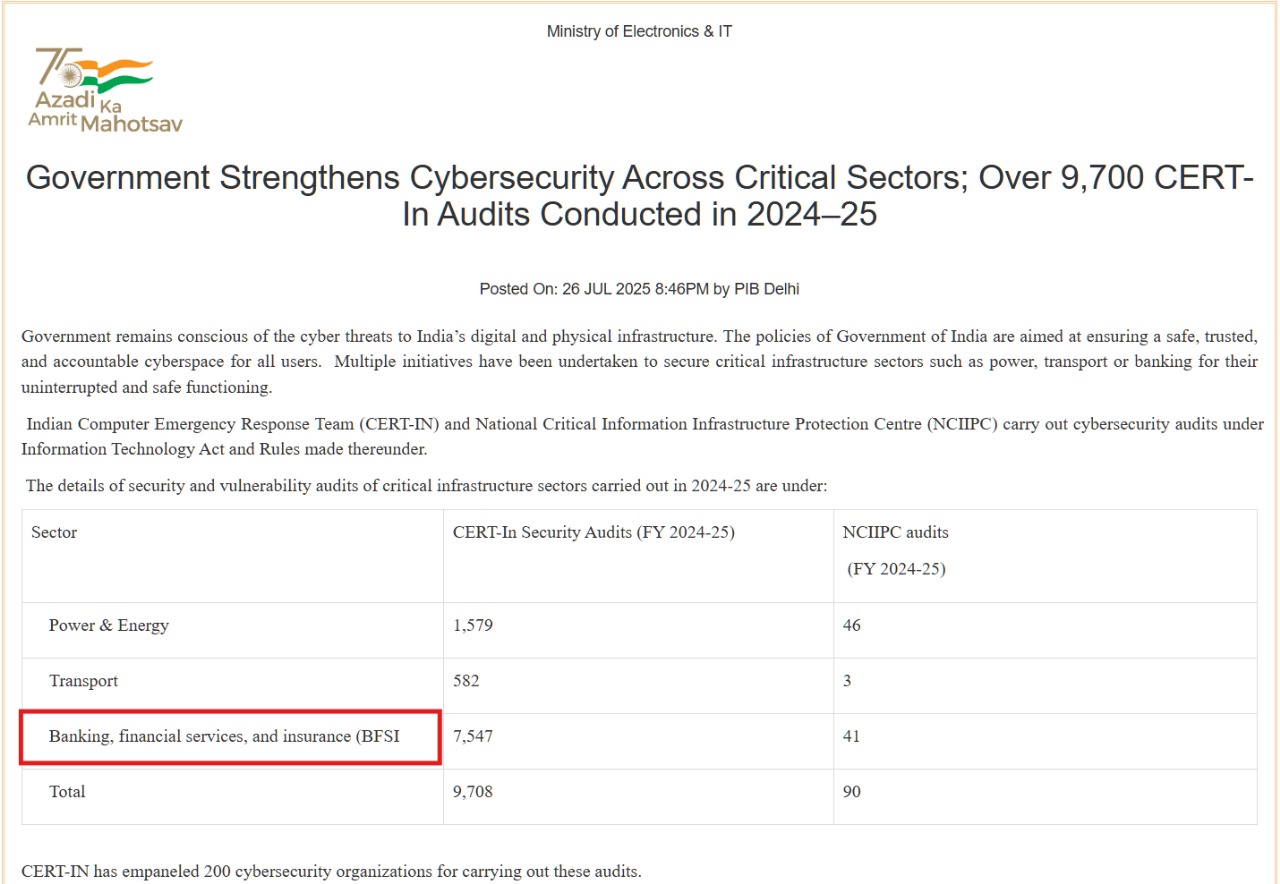

That’s where the government has stepped in. The Financial Intelligence Unit (FIU-IND) and CERT-In have now made cybersecurity audits mandatory for all crypto exchanges operating in India. This landmark regulation is not just compliance , it’s a crucial step toward trust and security in the fast-growing crypto market.

Why This Move Matters for Crypto Exchanges

Crypto platforms today handle billions of dollars in transactions daily. Unlike traditional banks, which operate under well-established regulatory frameworks, crypto exchanges often face lighter oversight and faster-evolving threats. This makes them more vulnerable to cybercriminals who exploit security loopholes to steal funds or manipulate systems.

The government’s mandate for regular cybersecurity audits is a step toward stabilizing this ecosystem. By making audits compulsory, the objective is clear:

- Prevent Money Laundering & Fraud

Stronger monitoring mechanisms will make it harder for illicit actors to use crypto platforms as safe havens for laundering black money or financing illegal activities. - Strengthen Consumer Protection

With user assets at constant risk of hacks, audits will help exchanges identify and plug gaps safeguarding investors from sudden financial losses. - Ensure Regulatory Compliance

By aligning exchanges with FIU-IND and CERT-In directives, India is bringing crypto security closer to global financial security standards. - Build Long-Term Trust in Crypto Adoption

Regulations and stronger security will increase confidence among retail investors, institutions, and policymakers helping India position itself as a leader in digital finance.

Cyber Threats Facing Crypto Exchanges

The risks crypto exchanges face are not hypothetical ,they’ve been proven time and again through global breaches and frauds. The most critical threats include:

- Exchange Hacks & Wallet Breaches

Attackers target exchanges’ hot wallets (those connected to the internet) to siphon off funds. A single vulnerability can lead to multi-million-dollar thefts, shaking investor trust overnight. - Money Laundering & Fraudulent Transactions

Without strong KYC and monitoring systems, exchanges can be exploited for laundering illicit funds. This not only damages credibility but also invites regulatory scrutiny and potential shutdowns. - Phishing & Credential Theft

Cybercriminals trick users and employees into revealing login details through fake websites, malicious emails, or social engineering. Stolen credentials allow attackers to bypass authentication and drain wallets. - Ransomware Attacks

Exchanges can be locked out of their systems by ransomware operators demanding payment in crypto. Beyond financial impact, such incidents can cripple operations and damage long-term reputations.

The Role of Cybersecurity Audits

Cybersecurity audits are not just regulatory requirements , they are essential shields against financial and reputational risks. When carried out effectively, audits deliver:

- Vulnerability Assessments

Detailed testing of applications, networks, and wallet systems to uncover weak points before attackers exploit them. - Compliance Verification

Ensuring that exchanges are aligned with FIU-IND and CERT-In directives, while also meeting international best practices. - Incident Readiness

Establishing clear policies, response playbooks, and detection mechanisms, so that when incidents occur, the response is swift and damage is contained. - Operational Transparency

Audits demonstrate a proactive approach to security, helping exchanges win investor confidence by proving they operate with accountability and resilience.

What Threatsys Brings to the Table

At Threatsys, we believe audits are not just about ticking compliance checkboxes ,they are about building real cyber resilience that protects businesses, customers, and the larger digital ecosystem. With our expertise in offensive security, compliance management, and threat intelligence, we help crypto exchanges strengthen their security posture in a fast-evolving threat landscape.

Here’s how we empower crypto platforms to stay secure and compliant:

1. Comprehensive Cybersecurity Audits

We go beyond surface-level scans. Our audits involve in-depth penetration testing, vulnerability assessments, and code reviews across exchange platforms, APIs, wallets, and mobile apps. This ensures that every layer of your ecosystem from transaction gateways to custody solutions is fortified against potential exploits.

2. Compliance Alignment

Staying compliant with FIU-IND, CERT-In directives, and international standards (ISO, GDPR, PCI-DSS) is crucial for both regulation and reputation. We guide exchanges through the entire compliance journey policy creation, gap analysis, risk assessment, and remediation ensuring regulatory confidence while avoiding costly penalties.

3. Threat Intelligence Integration

Cybercriminals are constantly innovating. That’s why we integrate dark web monitoring, fraud detection, and threat correlation tools into your security framework. By tracking stolen credentials, wallet addresses, phishing kits, and underground chatter, Threatsys helps you detect risks before they escalate into full-blown attacks.

4. 24/7 Monitoring & Incident Response

Crypto never sleeps, and neither do cyber threats. Our Security Operations Center (SOC) provides round-the-clock monitoring of networks, applications, and transactions. If an incident occurs, our rapid response teams ensure quick containment, forensic investigation, and recovery minimizing downtime, financial loss, and reputational damage.

5. Employee Awareness & Training

Technology is only as strong as the people behind it. Since most breaches start with human error like phishing clicks or weak passwords, we conduct tailored training sessions, phishing simulations, and awareness programs. This empowers employees to act as the first line of defense rather than the weakest link.

Conclusion: Building Trust in India’s Crypto Future

The government’s move to mandate cybersecurity audits is more than regulation ,it’s a safeguard for India’s digital financial ecosystem. With crypto adoption on the rise, exchanges that embrace security not only comply with the law but also win user trust.

At Threatsys, we partner with crypto businesses to ensure they don’t just meet compliance requirements but stay resilient, secure, and future-ready in the face of evolving threats.

At Threatsys, we don’t just secure your systems — we future-proof your growth.

Stay secure, stay resilient with Threatsys.